Which Step In The Budget Process Do Both Houses Of Congress Control?

Budget Process

What sort of state do you want to live in?

Do you want access to education? Health intendance? Clean energy? Job opportunities? How much are those things worth?

Does it make sense that the richest country in the globe yet has rampant poverty?

How did we end up with policies that nurtured white supremacy, mass incarceration and police violence, and what tin can we do to stop them?

Should nosotros carry community members who don't take immigration papers, or welcome them?

When is war justified?

Every one of today'southward hot button issues tin be found in the federal upkeep. How much we spend on education versus state of war, or health intendance versus incarceration, shows our values equally a nation. Those values may be very different from yours.

There have always been people who disagreed with our national budget priorities. History is full of examples of ordinary people working together to cease wars, expand health intendance, win ceremonious rights, and so much more. That story continues today, and y'all are a function of it.

How Information technology's Supposed to Work (and How It Does)

The U.S. Constitution promises the "power of the purse," or the ability to spend coin, to Congress.1 This part of the Constitution doesn't even mention the president. The constitution also grants Congress the say-so to create and collect taxes, and to borrow money when needed. The Constitution does not, yet, specify how Congress should exercise these powers, how to spend or raise money, or where the coin should go.

In 1974, in response to a dysfunctional budget procedure, Congress passed a police force setting some guidelines for how to create the federal budget. Over the course of the twentieth century, Congress passed laws that accept shaped the budget process into what information technology is today. Unfortunately, the budget process today is nonetheless rife with dysfunction – and yet, every year, Congress passes a budget. Nosotros'll tell you how information technology works.

The Annual Budget Process – What's In and What'south Out

The federal budget is made up of two major kinds of spending: mandatory and discretionary spending. A third category, involvement on the national debt, volition come up later.

To set up the federal upkeep, Congress passes two kinds of laws that set the budget for our state. The commencement are called authorization. These are necessary for both mandatory and discretionary spending. There are as well appropriations, which legislate what is known equally discretionary spending. The way issues end up in one bucket or the other has a lot to do with history.

Authorizations bills3 for mandatory spending often last several years. When a spending authorization finally expires, Congress can vote to continue it every bit is, or make changes. Congress can also brand changes along the fashion, just if they don't, this spending continues pretty much on auto-airplane pilot.

The biggest and most well-known examples of mandatory spending are Social Security, Medicare and Medicaid benefits. In these programs, how much is spent depends on how many people qualify. If lots of people retire and qualify for Social Security checks, more is spent. If fewer people retire, less is spent. Everyone who is eligible can get benefits.

And then at that place are appropriations bills, which focus on discretionary spending. Appropriations last just one twelvemonth, and practice set a specific budget. If that money runs out before the stop of the year, the regime tin't spend more unless Congress votes on a new appropriation. Then, Congress does it all again side by side year.

The biggest case of discretionary spending is the military budget, which accounts for half or more of the discretionary budget almost every year (the COVID-nineteen pandemic is a recent exception). The other half is split between things like public educational activity, housing, public health, medical research, energy, the environment, federal police force enforcement, and even veterans' benefits, which aren't part of the military budget. Most federal programs, and maybe nearly bug you intendance virtually, have to squeeze into this office of the federal budget.

The Annual Upkeep Process

The U.S. federal upkeep operates on fiscal years that run from Oct 1 to September 30. For example, FY 2021 ran from Oct 1, 2020 through September thirty, 2021. Each year, Congress sets discretionary spending levels through the appropriations process, with the President playing a supporting role.

This is how the appropriations process is supposed to go:

- The President submits a upkeep request to Congress for what he/she/they would like to run into.

- The House and Senate pass budget resolutions, setting total spending levels for the twelvemonth. They may or may not take the President'southward recommendations.

- Business firm and Senate Appropriations committees put together 12 detailed appropriations bills representing 12 carve up areas of government. This procedure takes a while.

- The House and Senate each vote on the 12 appropriations bills and iron out their differences.

- The President signs each of the 12 appropriations pecker. Now the budget is police force.

Step 1: The President Submits a Budget Request

According to federal law, the president should budget request to Congress each February for the coming fiscal year.v

To start, each federal agency works with the Office of Management and Budget, which is part of the White Business firm. The budget requests depict what the leaders of each government agency think they need to run things for the current year.

The Office of Direction and Budgets works with agencies to combine these budgets into the president's budget asking. The president's asking as well includes the president'due south preferred tax policies and how the government will bring in coin.

Only the president's budget request is only a proposition. Congress so writes its own appropriations bills, which may have little in common with the president's request. The president's ability over the budget comes largely from the ability to veto appropriations bills passed by Congress. Just after the president signs these bills (in stride five) does the country take a budget for the new fiscal yr.six

Pace 2: The House and Senate Pass Budget Resolutions

After the president submits his or her budget asking, the Business firm Committee on the Budget and the Senate Commission on the Budget each write and vote on their own budget resolutions.7

The budget resolution sets the year's spending limits for the 12 principal areas of federal discretionary spending. It as well includes estimates for how much money will be brought in through taxes and other ways. The budget resolutions from the House and Senate don't get into much detail or set funding for individual programs. That happens later.

The House and Senate each laissez passer their ain budget resolutions. Then, members from each come together in a joint briefing to iron out differences between the 2 versions – sometimes a very difficult and contentious process. If they can agree on a compromise version, the resulting "reconciled" version is then voted on once more and must laissez passer in each chamber.

Sometimes, Congress fails to pass a budget resolution setting spending limits – either because the Senate or Business firm (or both) fail to pass one, or because the Senate and House can't concur on a "reconciled" version. When that happens, it tin can make the rest of the process longer and more difficult.

Step iii: House and Senate Create Appropriation Bills

The Firm and Senate both have Appropriations Committees that are made up of members of Congress. These committees are responsible for determining the precise levels of budget authority, or immune discretionary spending, for all discretionary programs in the federal budget.viii

The Appropriations Committees in both the Business firm and Senate are broken downwards into 12 smaller appropriations subcommittees. Each of these are responsible for creating an appropriations bill. Subcommittees embrace different areas of the federal government: for example, there is a subcommittee for military spending, and another i for energy and water. Each subcommittee conducts hearings in which they seek additional information near how they should fund government agencies and programs.9

Based on all of this data, the chair of each subcommittee writes a offset draft of the subcommittee's appropriations nib, abiding by the spending limits set out in the budget resolution, if there was i. All subcommittee members then get chances to change the bill and vote on it. In one case they pass in their subcommittees, each of the 12 bills goes to the full Appropriations Commission. The larger committee can then modify it even more, and vote to send it to the total Firm or Senate for a concluding vote. In recent years, the Business firm and Senate have not followed this process. Instead of working on 12 singled-out appropriations bills, they take put all federal discretionary spending into one large appropriations bill known as an jitney. This tin result in rushed passage of a bill also big and complicated for anyone to fifty-fifty read – both concerned citizens, and even members of Congress themselves.

Step four: The House and Senate Vote on Appropriations Bills

Afterwards the commission votes, all 435 members of the Business firm of Representatives and 100 members of the Senate get a chance to vote on the 12 appropriations bills.

After the House and Senate pass their versions of each appropriations nib, a briefing committee meets to atomic number 26 out any differences betwixt the House and Senate versions – just like they did for the upkeep resolutions. Afterward the conference committee produces a single "reconciled" version of the bill, the House and Senate vote again, but this fourth dimension on a bill that is identical. After passing both the House and Senate, each appropriations bill goes to the president for his or her signature.10

In reality, the budget process tin (and often does) get stuck at whatever of the points along the way so far.

Step five: The President Signs Each Appropriations Bill and the Upkeep Becomes Law

The president must sign each appropriations bill subsequently it has passed Congress for the neb to become law. When the president has signed all 12 appropriations bills, the budget process is complete. Rarely, all the same, is work finished on all 12 bills by Oct. 1, the starting time of the new financial twelvemonth.

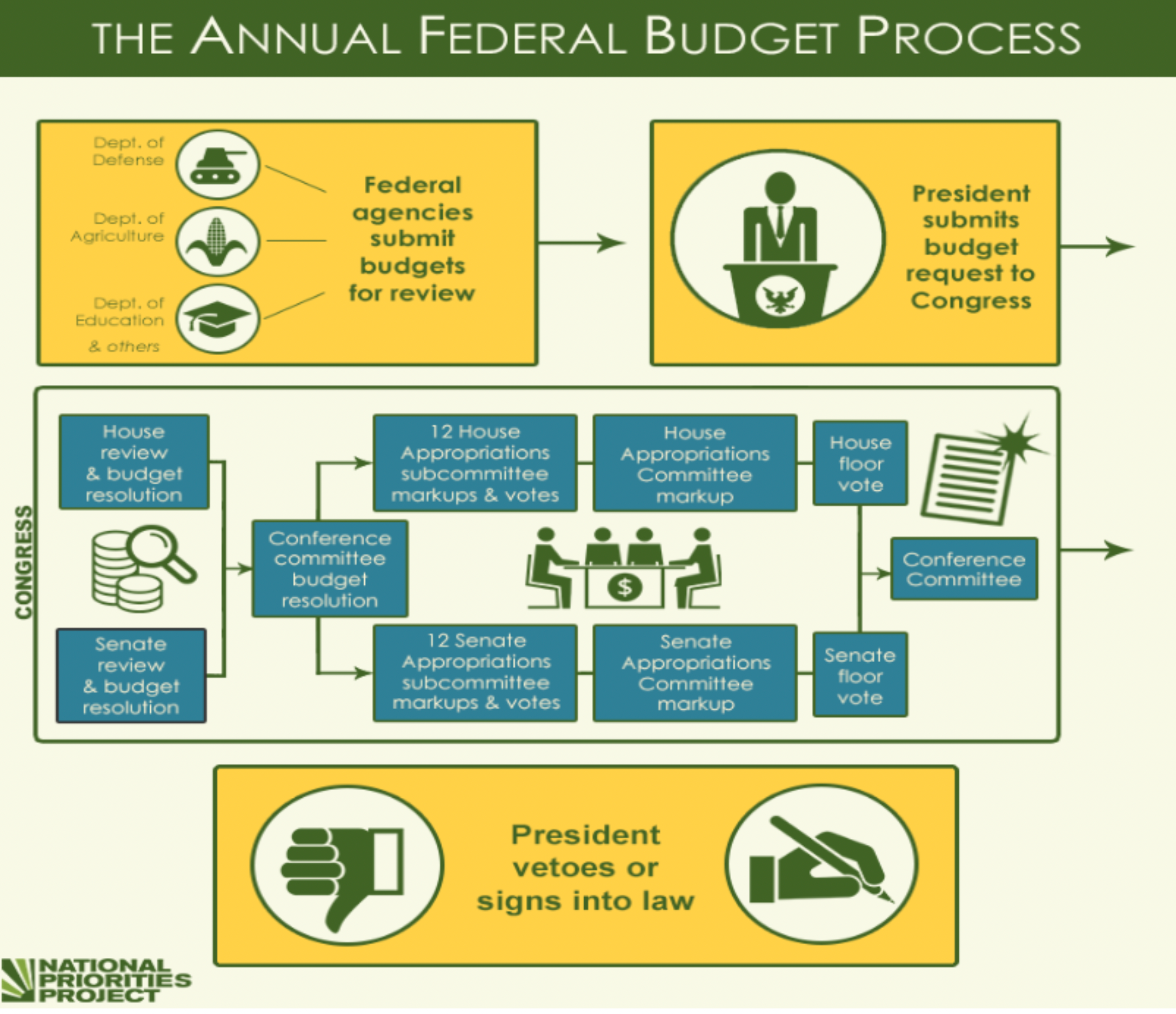

This nautical chart shows how all of these pieces fit together to make the almanac federal budget procedure.

Standing Resolutions and Motorcoach Bills

When the budget process is not complete past Oct. 1, Congress may pass a continuing resolution and so that agencies continue to receive funding until the total budget is in place.eleven.

If Congress does not pass appropriations or a continuing resolution by October i, the regime won't have coin to function. That results in a shutdown of the federal government, in which many parts of the government cease operating. This has happened many times over the years.

Supplemental Appropriations

From time to time the government has to respond to emergencies, such every bit the COVID-19 pandemic, natural disasters, or overseas conflicts. In these cases, the regime may need to appropriate more spending to handle the crisis. This type of funding is allocated through legislation known every bit supplemental appropriations.

It'due south Even Messier than It Sounds

The procedure above is the style the federal budget is supposed to be fabricated, but it rarely goes according to program. But regardless of how the process goes, there are e'er points where people in this country can counterbalance in to allow their representatives know what they want, and don't want, in the federal budget.

Endnotes

- U.South. Constitution, article i, section 8, clause 1.

- Congressional Enquiry Service, "Introduction to the Federal Upkeep Procedure," Written report 98-721, 3 Dec. 2012.

- Congressional Research Service, "Overview of the Authorization-Appropriations Process," Report 20-731, 26 Nov. 2012.

- Congressional Research Service, "Mandatory Spending: Evolution and Growth Since 1962," Report 33-074, 10 Mar. 2014.

- Congressional Research Service, "Introduction to the Federal Budget Process," Report 98-721, iii December. 2012.

- U.S. Constitution, article i, section 7, clause 2.

- Congressional Research Service, "The Congressional Budget Process: A Brief Overview," Report 20-095, 22 Aug. 2011.

- Congressional Research Service, "The Congressional Budget Process: A Brief Overview," Report xx-095, 22 Aug. 2011.

- Congressional Enquiry Service, "The Congressional Appropriations Procedure: An Introduction," Written report 42388, 14 Nov. 2014.

- Congressional Enquiry Service, "The Congressional Upkeep Procedure: A Brief Overview," Report 20-095, 22 Aug. 2011.

- Congressional Research Service, "Continuing Resolutions: Overview of Components and Recent Practices," Report 42647, 14 Jan. 2016.

Which Step In The Budget Process Do Both Houses Of Congress Control?,

Source: https://www.nationalpriorities.org/budget-basics/federal-budget-101/federal-budget-process/

Posted by: leapostrythe.blogspot.com

0 Response to "Which Step In The Budget Process Do Both Houses Of Congress Control?"

Post a Comment